Graduate PLUS Loan Instructions

Before beginning the application process on studentaid.gov, please read the important information below.

What is the Federal Direct Graduate Plus Loan?

The Graduate PLUS Loan is a federal Direct Loan that is in the student’s name for educational expenses not covered by other financial aid. To be eligible for the Graduate PLUS loan you must be a graduate or professional student enrolled at least half-time in a program leading to a graduate or professional degree or certificate.

To receive the Graduate PLUS Loan, the student must have a valid FAFSA on file.

The student must be U.S. citizens or eligible non-citizens, must not be in default on any federal education loans or owe an overpayment on a federal education grant, and must meet other general eligibility requirements for the Federal Student Aid programs.

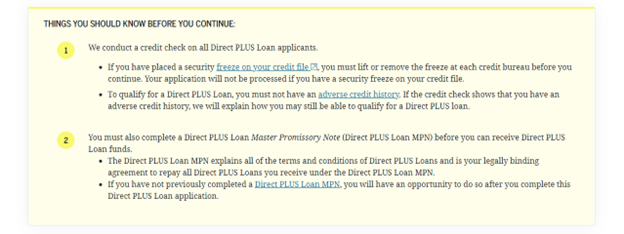

Is a credit check required?

Yes, a credit check is conducted on all Direct Graduate PLUS Loan applicants.

- If you have placed a security freeze on your credit file, you must lift or remove the freeze at each credit bureau before you continue. Your application will not be processed if you have a security freeze on your credit file.

- To qualify for a Direct PLUS Loan, you must not have an adverse credit history.

How much can I apply for?

The amount that a student may borrow is based on the cost of attendance minus any other financial aid and resources for the loan period. Typically, the maximum amount that a student can apply for is listed in the student’s financial aid portal.

All loans are subject to cost of attendance limitations. No awards may be granted to a student who has reached the limit of his/her financial aid cost of attendance. If additional resources are received by the student after loans have been awarded, the loans may be reduced and funds returned to the U.S. Department of Education.

What is next if I am approved?

If approved for the Graduate PLUS Loan, the borrower must sign a Direct PLUS Master Promissory Note at studentaid.gov, using his or her Federal FSA ID (if he or she has not already done so). If the student has not previously received a PLUS loan, he or she will also be required to fill out the entrance counseling on studentaid.gov.

- The Direct PLUS Loan MPN explains all the terms and conditions of the Direct PLUS Loan and is your legally binding agreement to repay all Direct PLUS Loans you received under the Direct PLUS Loan MPN.

- Entrance counseling ensures you understand the terms and conditions of your loan and

your rights and responsibilities. You'll learn what a loan is, how interest works,

your options for repayment, and how to avoid delinquency and default.

When you're finished the MPN and entrance counseling, a record of your completion will be sent to the schools you selected, and you can then receive your loan money. Keep in mind that you cannot save and leave an incomplete session; you must complete entrance counseling in one sitting.

What is next if the credit check is denied?

If your Graduate PLUS loan is denied due to the result of your credit review, you will receive notification from the Federal Student Aid Information Center. You may choose from the following options:

- You may try to have a credit status override completed by the Federal Student Aid Information Center. Please contact the Federal Student Aid Information Center at 1-800-433-3243.

- You may provide documentation to the Federal Student Aid Information Center if you have extenuating circumstances. Your request for a Graduate PLUS loan will be reviewed again by the servicer.

- You may have a third-party endorser co-sign the Graduate PLUS loan application with

you. The Federal Student Aid Information Center will send you a packet of information

for this option. If additional information is needed, please contact the Federal Student

Aid Information Center at 1-800-433-3243.

If you qualify by obtaining an endorser or by documenting to the satisfaction of the U.S. Department of Education that there are extenuating circumstances related to your adverse credit history, you’ll also be required to complete PLUS counseling before you can receive a Direct PLUS Loan. This PLUS counseling is in addition to the Entrance counseling requirement. - If you apply for a Direct PLUS Loan and are notified that you have an adverse credit history, you’ll be given detailed information on the options for qualifying by obtaining an endorser or submitting documentation of extenuating circumstances, along with instructions on how to complete the required PLUS counseling. This PLUS Counseling is in addition to the Entrance counseling requirement.

What is the interest rate for a Graduate PLUS loan?

You can view the interest rates for the Direct Graduate Plus Loan using the link below.

Graduate PLUS loans | Federal Student Aid

Other than interest, is there a charge for this loan?

Yes, there is a loan fee deducted from each disbursement. You can view the loan fee percentage at the link below.

Graduate PLUS loans | Federal Student Aid

When will the Graduate PLUS loan be disbursed?

In accordance with federal loan regulations and LSU’s disbursement schedule, the loan will be applied to your LSU account once all the requirements are met. If all requirements are met, the loan funds will be disbursed prior to the term the student is enrolled in. If the Graduate PLUS loan funds result in a credit on your LSU account, a refund will be sent to you either by direct deposit (if applicable) or check.

*You may cancel all or a portion of your loan after funds have been credited to your student’s LSU account by notifying LSU in writing within 30 days.*

Is my loan deferred while I am in school?

Yes. While you are enrolled in school at least half-time (6 credit hours), you are automatically placed in an in-school deferment status that allows you to postpone payments on your Graduate PLUS loan until you graduate or drop below half-time.

How soon do I have to begin making payments after my in-school deferment ends?

Your first payment will be due 6 months after the in-school deferment end date. This

timeframe is known as your grace period. The Direct Loan Servicing Center will notify

you 60 days before your deferment ends.

Consent to Obtain Credit Report

The information on your application may be disclosed to third parties as authorized under routine uses in the Privacy Act notices called “Title IV Program Files” (originally published on April 12, 1994, Federal Register, Vol. 59, p. 17351) and “National Student Loan Data System” (originally published on December 20, 1994, Federal Register, Vol. 59, p. 65532). Thus, this information may be disclosed to parties that The U.S. Department of Education authorizes to assist them in administering the Federal Student Aid programs, including contractors that are required to maintain safeguards under the Privacy Act. Disclosures may also be made for verification of information, determination of eligibility, enforcement of conditions of the loan or grant, debt collection, and the prevention of fraud, waste, and abuse and these disclosures may be made through computer matching programs with other Federal agencies.

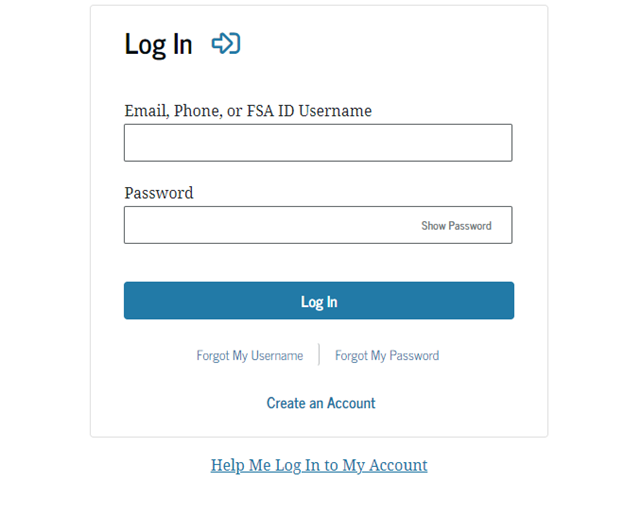

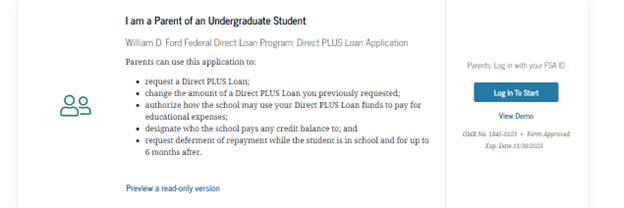

To access the Direct Graduate Plus Loan application, please visit studentaid.gov.

You must have a FSA ID in order to log in and complete the Direct graduate Plus Loan Application. If you do not have an account, you can create one by clicking create account on the home page of studentaid.gov.

Step 1 (If you do not already have an account):

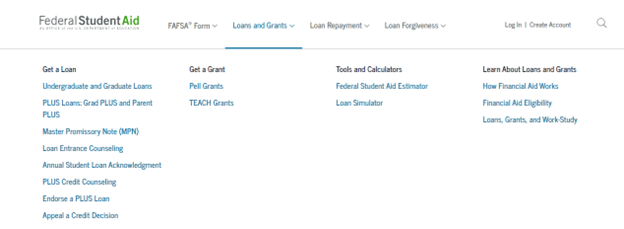

Step 2:

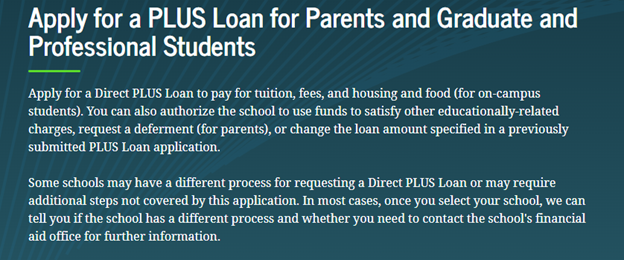

Step 3:

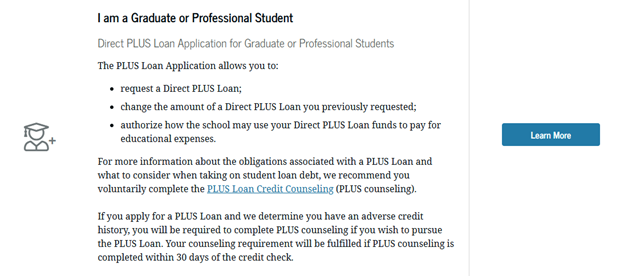

Step 4:

Step 5: